Drug Delivery Trends for 2024

23 January 2024

Tom Oakley and Kamaal de Silva consider how keeping abreast of the latest trends can help the industry predict and prepare for the future.

The booming market for weight management drugs

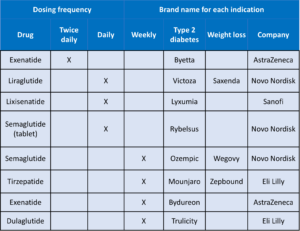

Delivery devices for weight management drugs such as GLP-1s are, unsurprisingly, attracting huge development interest and funding. Originally developed to treat Type 2 diabetes, several GLP-1s have been approved for weight management and weight loss since Saxenda (liraglutide, Novo Nordisk) was approved in December 2014 (Table 1).(1)

Table 1: Example GLP-1s and their brand names for diabetes and weight management indications.

The GLP-1 market is forecast to increase at 6.1% compound annual growth rate from 2021 to 2028, from a starting point of US$12.7 billion (£10.0 billion) in annual sales.(2) This projection may be conservative if GLP-1s are approved for additional indications, such as reduction of cardiovascular disease.

Most GLP-1 drugs need to be injected, but some oral GLP-1s are coming to market, for example, Rybelsus (semaglutide, Novo Nordisk), which was approved by the US FDA in September 2019, and by the EMA in April 2020.(3)

The first GLP-1s to come to market used repurposed insulin pens, or adaptations of existing autoinjector platforms. With the new GLP-1s in development, and the biosimilars coming to market, there is substantial opportunity (and funding) to develop better delivery devices.

Closed-loop insulin systems (Artificial pancreas)

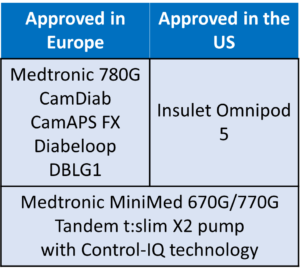

Since the FDA approved the MiniMed 670G in 2016, there have been several new hybrid artificial pancreas systems approved by regulators for the treatment of Type 1 diabetes (Table 2). The essential components of such a system are a continuous glucose monitor (CGM), an insulin pump and an algorithm, where the latter can be implemented in the pump itself or on a separate device such as a mobile phone.

Table 2: Hybrid closed-loop systems approved for Type 1 diabetes in Europe and the US.(4)

The time taken to develop, validate and launch these systems has prompted some people to adapt or develop their own DIY closed-loop systems, an example being the Nightscout project, which uses the tagline #WeAreNotWaiting.(5) The risks of using systems that have not been through regulatory approval are being addressed by initiatives such as Tidepool, which achieved FDA clearance for Tidepool Loop in January 2023.

High costs are also a large factor in driving users to DIY systems.6 However, approved systems will be provided by an increasing number of public health providers, such as the UK NHS, over the next few years.(7) This increase in user base should lead to increased interest and investment in 2024.

The significant market for diabetes management has fuelled significant innovation in closed-loop delivery systems, but similar technologies are expected to be applied to a range of indications outside of diabetes where self-monitoring and self-administration can bring benefits for patients and payers.

Large-volume injection

Large-volume injection continues to be a hot topic due to the formulation requirements of some new biologics and the preference to move some therapies from intravenous infusion to subcutaneous injection. There are two main categories of delivery devices for large-volume subcutaneous injection:

- On-body delivery systems, also called patch pumps, bolus injectors and other names

- Large-volume autoinjectors.

Relatively recent approvals of on-body delivery systems include Alexion’s (MA, US) Ultomiris® (ravulizumab-cwvz) in the West Pharmaceutical Services SmartDose platform in September 2022,(8) and Apellis Pharmaceuticals’ (MA, US) Empaveli® (pegcetacoplan) in the Enable Injections enFuse platform in September 2023.(9) There are many other on-body delivery systems in development, with some on the market.(10)

The biggest change in the past year, and the biggest question for 2024, is the emergence of large-volume autoinjector platforms. Most autoinjector platforms are based on a 1 mL staked needle and, in recent years, 2.25 mL syringes have started to be supported. The increasing capability for larger volumes has been extended to 3 mL in cartridge-based autoinjectors, such as Gerresheimer’s Inbeneo or SHL Medical’s Maggie platforms.

In the past year or so, several autoinjector families have been extended to 5.5 mL, such as Ypsomed’s YpsoMate 5.5 (based on a syringe)(11), and SHL’s Maggie 5.0 (based on a cartridge).(12) The question is how much these 3 mL and 5 mL autoinjectors will eat into the market for on-body injectors.

Opthalmic injections

Ophthalmic injections have specific requirements that mean that standard injection systems are often inappropriate, such as:

- Very low particulate limits

- No suction

- Minimal increase in intraocular pressure

- Difficult access and targeting

- Small dose volumes and strict dose accuracy.

The ophthalmic drugs in development, and the new solutions that they require, have created a steady stream of device innovation over recent years that is expected to continue, or even increase, in 2024.

The ophthalmic drug delivery market is split roughly equally between topical applications and injections, so it is important to remember the innovation opportunities for topical applications such as eyedroppers or, more recently, spray devices. The usability of preservative-free eyedroppers could be improved, for example, by reducing their squeeze force, reducing the chance of multiple drops and assisting alignment with the eye.

New development budgets for 2024

Every annual cycle comes with its changes to budgets, so why raise the subject for 2024? The reason is that the healthcare industry went through a substantial boom from mid-2020 through to late 2021, or perhaps even mid-2022 (coined the “covid dividend”),(13) and a market correction since then.

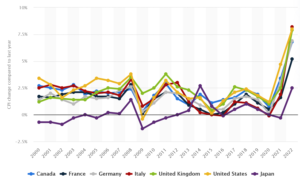

Figure 1: Annual inflation rates in G7 countries from 2000 to 2022.(14)

The healthcare industry has faced significant headwinds since the middle of 2022, including:

- The full-scale Russian invasion of Ukraine leading to shocks in financial markets and some supply chains

- Energy prices increasing substantially

- High inflation pushing up wages and other costs (Figure 1)

- The sales of various covid-19 mitigations reducing substantially, such as vaccines, other covid-related drugs, personal protective equipment, certain diagnostics, critical care equipment and so on.

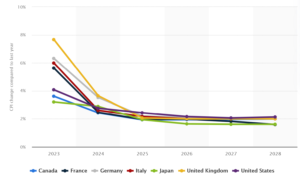

These headwinds led to waves of redundancies and budget cuts through 2023. With inflation reducing in leading economies (Figure 2) and the industry having made corrections for the other adverse factors, there is cautious optimism that 2024 will return to increased investment in R&D and innovation.

Some companies are displaying corporate agility and moving back towards investment for 2024. Fast-forwarding to the end of 2024, it can be expected that those agile companies will have a competitive advantage over those that continue to restrict investment in R&D.

Figure 2: Forecast of annual inflation rates in G7 countries from 2023 to 2028.(15)

Summary

Sales of GLP-1s are predicted to increase and the trend is expected to accelerate if new indications, such as reducing cardiovascular disease, are approved. This means there will be greater funding and demand for improved GLP-1 delivery devices.

Closed-loop diagnostic-and-delivery systems are maturing for diabetes. The principles involved could be applied to many other indications, perhaps with new devices and algorithms tailored to the different user needs and technical requirements.

New on-body large-volume delivery systems continue to gain regulatory approvals and face competition from large-volume autoinjectors. Meanwhile, ophthalmic drug delivery is an area ripe for innovation in 2024, for both injection and topical devices.

Finally, 2024 promises to be a year of increased investment in drug delivery devices as companies emerge from the post-covid correction in healthcare sales and economists predict reductions from uncharacteristically high energy prices and inflation. It remains to be seen which companies are most agile in adapting to the new opportunities in drug delivery.

If you have questions or would like to discuss any points, please do not hesitate to contact the authors.

References

- “Saxenda FDA Approval History”. Drugs.com, Jan 2021.

- “GLP-1 Receptor Agonist Market Will Generate Massive Growth 2022-2028 | Eli Lilly and Company, GlaxoSmithKline plc, Novo Nordisk A/S”. Medgadget, Feb 2022.

- “Rybelsus FDA Approval History”. Drugs.com, Jan 2020.

- Nimri R, Philip M, Kovatchev B, “Closed-Loop and Artificial Intelligence-Based Decision Support Systems”. Diabetes Technol Ther, 2023, Vol 25(S1), pp S70–S89.

- “Welcome to Nightscout”. Web Page, Nightscout, accessed Dec 2023.

- Dermawan D, Purbayanto MAK, “An overview of advancements in closed-loop artificial pancreas system”. Heliyon, 2022, Vol 8(11), e11648.

- “New “artificial pancreas” technology set to change the lives of people having difficulty managing their Type 1 diabetes”. NICE, Jan 2023.

- Kemp A, “Ultomiris approved in Europe for the treatment of adults with generalised myasthenia gravis”. AstraZeneca, Sep 2022.

- “Enable Injections Receives First U.S. Food and Drug Administration (FDA) Approval”. Press Release, Enable Injections, Oct 2023.

- Oakley T, “On-Body Delivery Systems – News and Trends”. ONdrugDelivery, Issue 137 (Sep 2022), pp 12–16.

- “YpsoMate 5.5 – the 5.5 mL large volume autoinjector”. Web Page, Ypsomed, accessed Dec 2023.

- “Maggie® 5.0”. Web Page, SHL Medical, accessed Dec 2023.

- Oakley T, “Top Five Drug Delivery Trends for 2021”. ONdrugDelivery, Issue 117 (Mar 2021), pp 8–10.

- Dyvik EH, “Inflation rates in G7 countries 2000-2022”. Statista, Mar 2023.

- Dyvik EH, “Inflation rate forecast in G7 countries 2023-2028”. Statista, Nov 2023.